Sales of nonwoven air/gas and liquid filtration media, worth $6.1 billion in 2024, are projected to increase strongly according to Smithers, the global authority on the nonwovens industry.

This will increase to $10.1 billion in 2029 (at constant pricing). The sector will experience a 10.7% compound annual growth rate (CAGR) according to a new report,

The Future of Nonwovens for Filtration to 2029.

Across the forecast period, global consumption of nonwovens for filtration will increase from 826,500 metric tonnes in 2024 to 1.1 million tonnes in 2029, equivalent to a 5.9% CAGR.

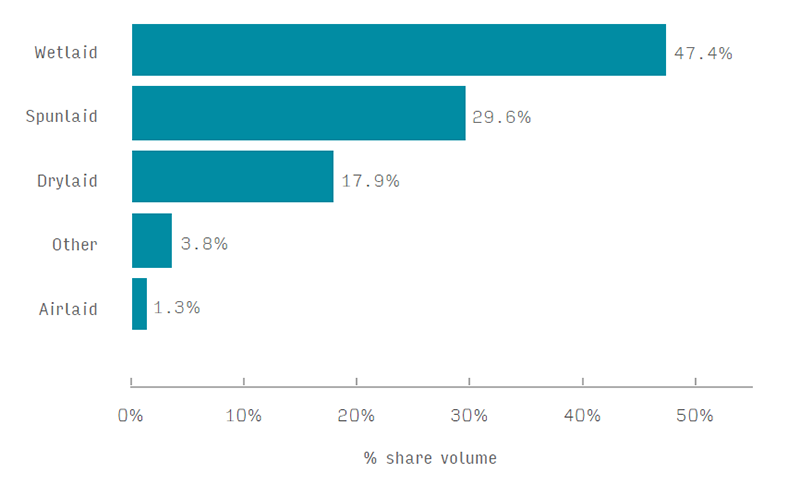

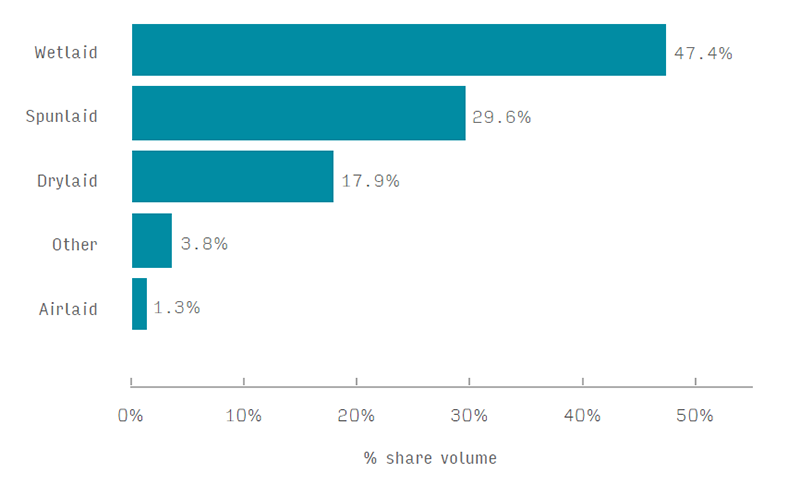

Nonwovens for filtration are dominated by three major processes: wetlaid, spunlaid and drylaid (needlepunch).

Unlike the broader nonwovens market, wetlaid is the leading nonwoven process for filtration – accounting for 47.4% of consumption in 2024. Wetlaid has benefited from the global drive for more sustainable products; it will exhibit a slower, but still good growth rate across 2024–29.

Spunlaid accounts for the second largest share at 29.6% of the contemporary market. In filtration, the huge surge in demand for face masks during Covid-19 in 2020–21 spurred widespread investment in meltblown spunlaid lines. Post-Covid, face masks still enjoy some increased consumption; but there is overcapacity, which is reducing prices, and encouraging consumption.

Drylaid nonwovens is the last of the major nonwoven processes for filtration, accounting for 17.9% of the market in 2024. Drylaid will be the slowest growing of the main processes used in filtration nonwovens.

North America is the largest consumer of nonwovens for filtration, although demand in Asia is rapidly expanding. In 2024, North America accounted for 42.8% of consumption by weight, followed by Asia (28.2%) and Europe (22.7%). Asia will continue to grow across 2024-2029, with its market share reaching 33.6% in 2029.

The Future of Nonwovens for Filtration to 2029 segments the market by raw material type, nonwoven process, end-use application, and geographic region. This is supported by analysis of major future trends, including new performance requirements, geopolitical developments, regulatory changes, and the demand for greater sustainability in nonwovens.

FIGURE 1. Global nonwovens for filtration consumption by process, 2024 (% share volume)

Source: Smithers

Source: Smithers

Source: Smithers

Source: Smithers