Global consumption of cartonboard will reach 56.3 million tonnes in 2025, valued at $58.9 billion, according to new research from Smithers, the global authority on the packaging industry.

This will be converted into 52.4 million tonnes of packaging, with a value of $132.8 billion. The new market report –

The Future of Folding Cartons to 2030 – shows that demand will push global consumption of folding cartons to 63.1 million tonnes in 2030, with value increasing to $159.6 billion at constant pricing.

Demand for cartonboard and microflute packaging is driven by the global trend towards sustainability in many markets, not least in packaging. This is seeing a marked trend away from plastic packaging formats in favour of paper-based solutions. There is general growth in demand from the emerging economies in the Asia-Pacific region and Africa.

The EU Single-use Plastics Directive has now been joined by the more wide-ranging Packaging and Packaging Waste Regulation (PPWR), which will require all packaging to be designed to optimise recyclability. This will only apply from 2030, but many brand owners are already investing in new cartonboard formats, including greater use of microflute in e-commerce channels.

Smithers analysis identifies the top applications where cartonboard is poised to take market share from plastics. These include collation and shrink-wrap films used in consumer multi-packs, trays for fresh produce and foodservice applications, and the development of all paper blisters for products like stationery.

Growth will be highest in confectionery, chilled food, food service, soft drinks and beer segments. The greatest share of increased incremental demand across 2025-2030 will come from healthcare customers. This reflects mainly new sales into developing regions of Asia, accompanied by some design innovation in mature markets.

Folding boxboard (FBB) and coated recycled board/white-lined chipboard (CRB/WLC) remain the most widely used folding carton grades – together accounting for 83.8% of contemporary demand. Across 2025-2030 FBB will continue to grow market share, with new paper machines coming online in Brazil, China and elsewhere in Asia. Extra capacity for solid bleached board/sulfate (SBB/S) is also now coming on stream supporting further sales over this period. In contrast sales of solid unbleached board/sulfate (SUB/S) and uncoated recycled board (URB) grades will continue to track below the market average.

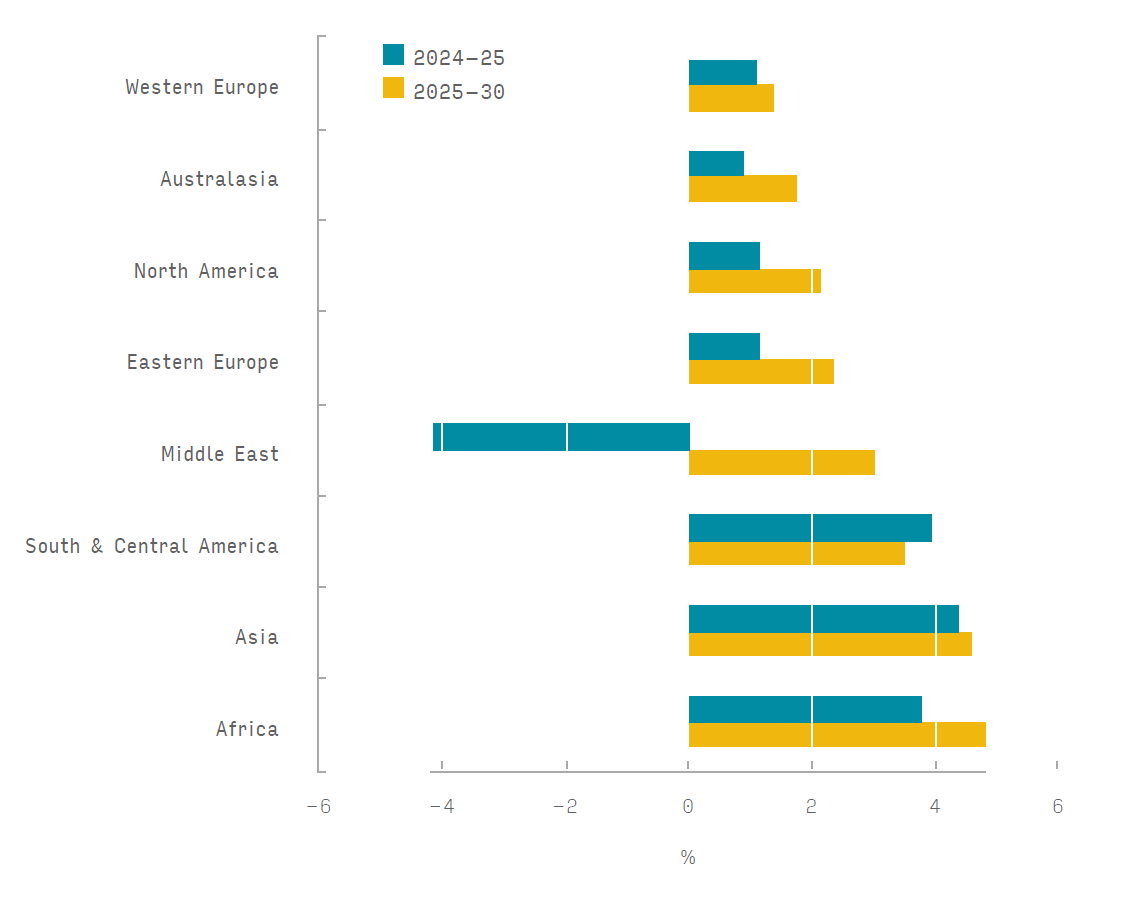

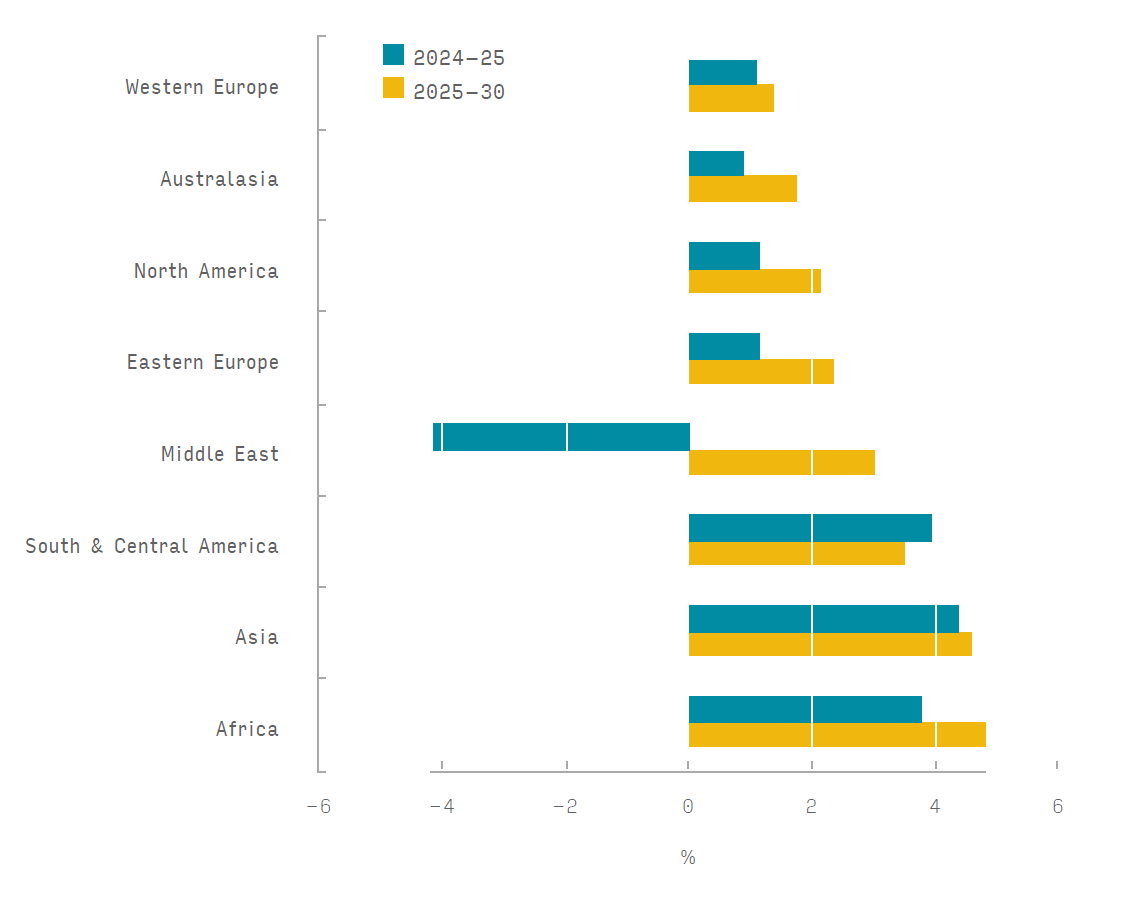

Figure 1: Anticipated growth in consumption volume for folding cartons by region, 2024–25 and 2025–30, annual % change

Source: Smithers

Source: Smithers

Source: Smithers

Source: Smithers