(Leatherhead, Surrey, UK) August 22, 2023 — Demand for printed labels, release liners, shrink and stretch sleeves continues to grow according to the latest in-depth market modelling from Smithers.

Available to purchase today, data from its new study –

The Future of Global Label and Release Liner Markets to 2028 – project that in 2023 demand for labels will reach 78,257 million meters square, with a value of $43.37 billion. Labelstock release liners add an extra $9.97 billion to the contemporary market.

Labels suffered from a fall in demand during 2020-2021 as Covid lockdowns hit CPG sales, but the sector has recovered lost value quickly. Smithers forecasts that value in labels will expand at a +2.8% compound annual growth rate (CAGR) to reach $49.73 billion in 2028, at constant pricing. Volume will increase faster +3.5% CAGR over the same period to reach 93.00 million meters square in 2028.

There is scope for label suppliers, converters, and print service providers to secure new revenue by bringing a host of innovation to the market.

Sustainability is now a core concern across print and packaging. This is seeing investment in paper labelstocks, polymer substrates made with post-consumer recycled (PCR) plastics, wider use of linerless labels, bio-based inks and adhesives, and innovations in technologies to allow for the effective removal of label materials during recycling.

Several regulatory developments will require the labels of tomorrow to carry more information. The US is poised to enact traceability requirements for pharmaceuticals in November 2023, following the example of the EU. Other serialization mandates requiring item-level tracking codes are set to enter into force soon. In food and beverages there are obligations to include more information on labels, including allergen warnings and healthy eating messages.

These is also a push to include more security features on labels, to protect against counterfeiting. Brand owners can use some of the same smart technology – such as item-specific QR codes – to connect with consumers, a value-adding model that label converters can leverage. The greatest revenue will come as and when these can be integrated with digital market platforms, linking physical and online experiences seamlessly.

To provide penetrating sector-specific insight, Smithers market analysis subdivides the market by label type, release liner type, print method, end-use application, national and regional market.

This shows that pressure-sensitive formats are still the preferred option (44.1%) of the market in 2023 by surface area, and have the best outlook for sales growth. Demand for pre-gummed labels is turgid, and only limited increase in use of wet-glue labels (40.0% of volume in 2023) is forecast. Volumes of shrink and stretch sleeves (12.5% and 3.3% respectively) are set to increase at the fastest rate through to 2028; creating an impetus for solutions that are can be detached easily during end-of-life processing.

Glassine/calendered kraft will remain the principal material for release liners. Accounting for 36.5% of contemporary volume demand, this share will drop slightly over the next five years. Simultaneously technical considerations will help increase volumes of film and polyolefin coated release liners, through to 2028; and there will be moderate increase in the use of clay coated kraft liners.

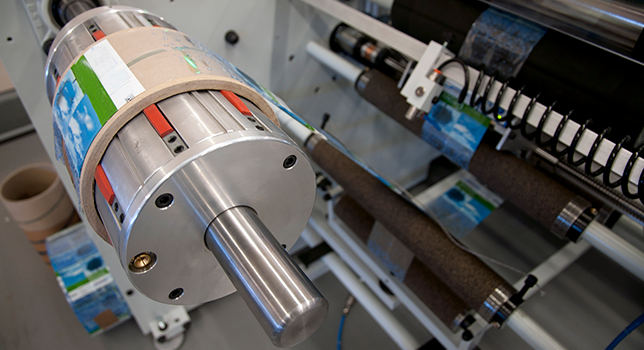

The majority of labelstocks are printed on analog presses – flexo accounts for 39.6% of the contemporary market by surface area, and offset litho a further 28.1%. The fastest increase is in narrow web printing on digital (inkjet and electrophotography) presses, including hybrid configurations. Smithers analysis shows that use of digital print will increase at a +12.3 CAGR to 2028.

Historic, current, and future demand for labels, release liners, and sleeves is dissected in forensic detail in the new Smithers study The Future of Global Label and Release Liner Markets to 2028. Penetrating analysis of contemporary and emergent trends is presented in an exclusive data set. With over 170 tables and figures, this sub-divides the market by:

- Label type – Pressure-sensitive, wet-glue, pre-gummed, shrink sleeve, stretch sleeve, in-mold label

- Release liner type – Glassine/calendered kraft, clay-coated kraft, polyolefin-coated paper, film, other paper

- Print process – Offset litho, flexo, gravure, screen, digital, unprinted

- End-use application – Food, sft drinks, alcoholic drinks, healthcare, cosmetics, other consumer, industrial/others

- National/region market – Western Europe, France, Germany, Italy, Scandinavia, Spain, UK, Rest of W Europe; Eastern Europe, Russia, Poland, Rest of E Europe; North America, Canada, Mexico, US; South & Central America, Brazil, Other S&C America; Asia, China, India, Japan, Other Asia; Rest of the World, Turkey, Other RoW.

Smithers dataset is segmented by world region, and supported by critical analysis of contemporary technology trends, their impact, and the opportunities and challenges these will create along the print value chain.