A new report from Smithers,

The Impact of Autonomous Vehicles on Tires to 2029, calls for the automotive industry to shift from selling and servicing vehicles to a mobility industry that offers transportation solutions for people and goods. Electrification, autonomous vehicle technology and shared mobility are key to this shift as is the evolution of tire development.

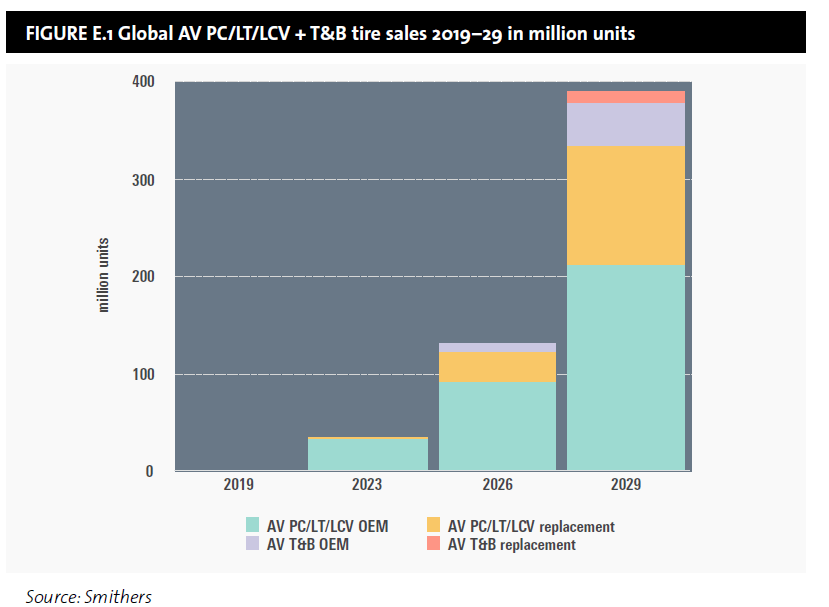

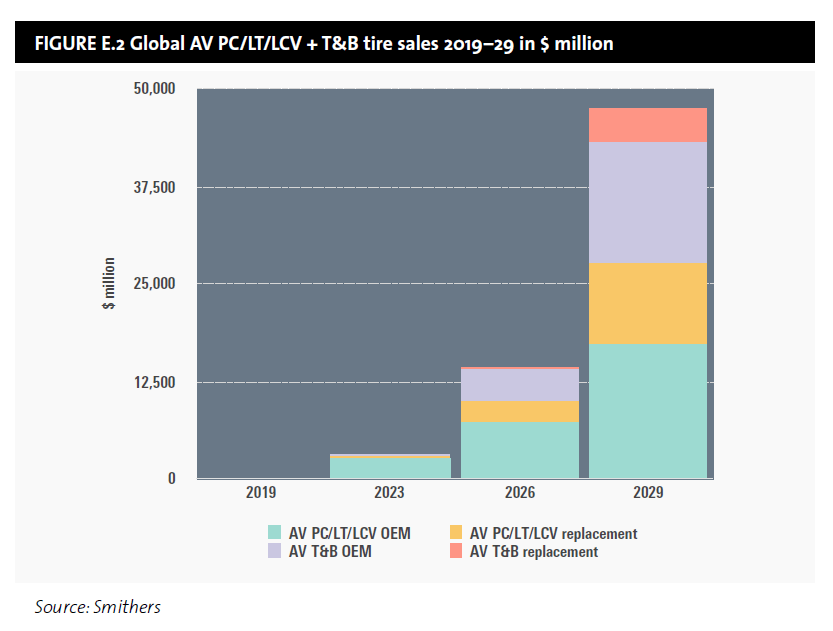

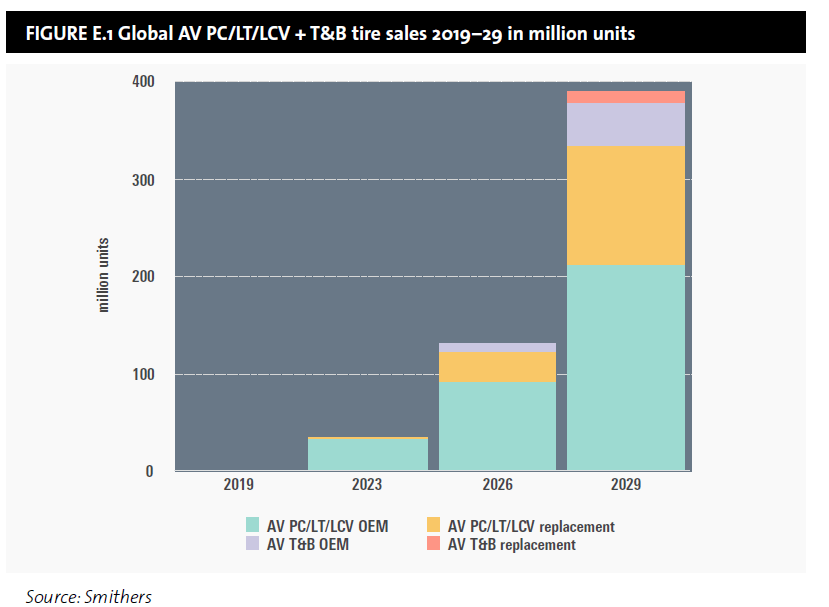

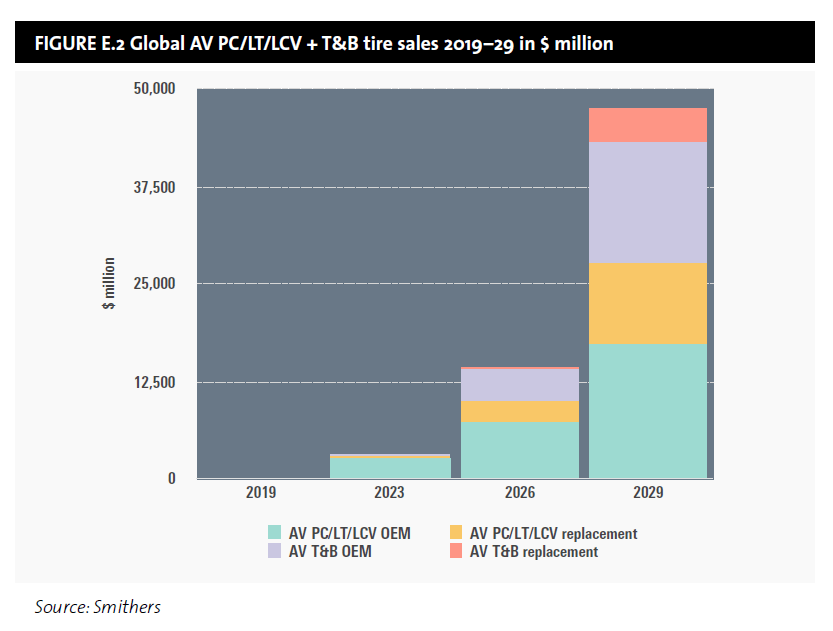

There are significant hurdles to be overcome before full AVs can be widely adopted. These vehicles will make up a relatively small part of new vehicle sales, and an even smaller part of the global vehicle parc by 2029. Small shuttles, delivery vans and truck platooning are possible exceptions. In relation, the number of tires supplied for AV vehicles by 2029 will be small and predominately OE. These units are forecast to reach around 389 million (AV PC /LT/LCV + T&B) at a value of over $47 billion by 2029, reaching about 15% of the predicted PC/LT/LCV + T&B tire market volume in 2029.

AVs and tires types

Debate exits over whether AVs will advance the use of extended mobility tires and if so, which option – run-flat or selfsealing – will be used. Smithers conducted a survey that revealed mixed expectations from industry respondents. A significant number believe that more careful tire use by AVs will reduce failure and decrease the need for extended mobility solutions. While not essential for AVs, non-pneumatic tires are puncture proof and offer extended mobility and less maintenance. They may benefit AVs used in urban environments, especially autonomous taxi fleets.

Regional trends in AV uptake

The penetration of EV and AV technologies will vary significantly between regions as political considerations play a strong role in introducing the necessary legislation. The relatively light regulatory environment in some states and the entrepreneurial culture in the US is expected to help. AV uptake in Europe may be hindered by the region’s strong regulatory nature. Customer acceptance varies greatly by geographical location and age.

The Smithers survey found that uptake of level 4–5 AV for PC/LT/LCV was expected to be North America>Europe>Asia Pacific. For trucks and buses, the order was predicted as Europe>North America>Asia Pacific. The higher rating for Europe T&B was due to the region’s interest in platooning. While all propulsion systems can be used, most AVs are expected to be electric. Not only do EVs provide significant synergies to AV, environmental concerns are leading to their adoption irrespective of AVs.

Tire sales for AVs to 2029

Because of the relatively small vehicle numbers, tires sales for AVs are expected to be a small part of the overall tire market by 2029 with OE sales dominating over replacement sales. Vehicle sectors in this report are differentiated into passenger car/LT/LCVs and T&B. Smithers was unable to quantify the passenger car and LT/LCV separately, but believe that LT/LCVs will be a relatively small part of the total. These are further differentiated into OE and replacement markets. The difference between OE and replacement markets is most pronounced in the PC/LT/LCVs tire sectors. See Figures E1 and E2.

Most survey respondents think the overall AV market (PC/LT/LCV + T&B level 2–5) will have most impact on AV tire materials/components and AV tire retail and AV tire marketing over the next 10 years. They rated the impact on these sectors as

very high or

high. AV tire materials/components is seen as the tire market sector that experiences the most innovation and change and generally moves forward faster than the other tire market sectors.

Find out more information and download the brochure here: The Impact of Autonomous Vehicles on Tires to 2029