The security print industry is responding to the challenge of retaining profitability as the identity market undergoes radical realignment, with the emergence of digital identity platforms and new demands from governments reacting to the Covid-19 pandemic.

New data from the Smithers report

The Future of Personal ID to 2025 shows that security printing of personal IDs will reach $9.63 billion in 2020, and grow at a compound annual growth rate (CAGR) of 2.5% to reach $10.90 billion in 2025.

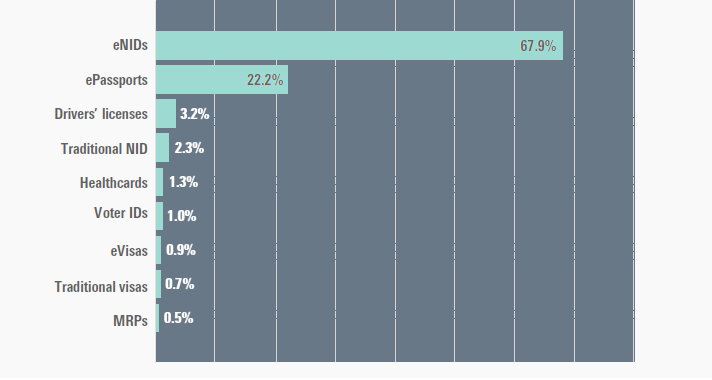

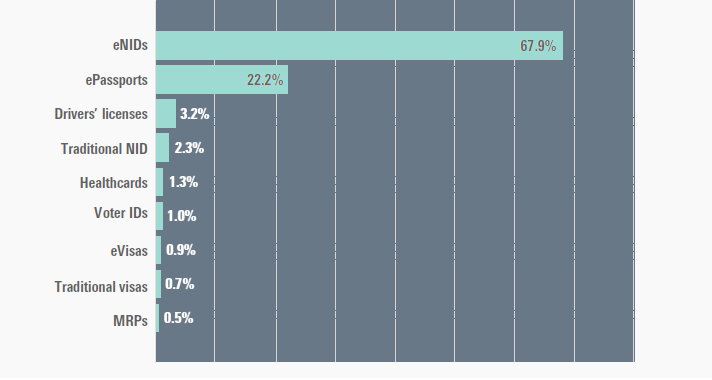

Smithers survey and market data profiles 10 leading personal ID documents (ePassports, machine readable (MR) passports, National IDs (NIDs), eNIDs, birthing certificates, driving licences, visas, eVisas, Voters IDs, and health cards). Electronic national IDs and passports are now the norm in most countries and represent 90% of the world market, providing a foundation for a further transition towards digital identity platforms.

Market size for personal ID documents, percentage share, by value, 2020

Source: Smithers

Source: Smithers

The form of personal ID documents are experiencing significant change as traditional forms of identity shift to digital and mobile.

As citizens come to embrace contact-free effective and hassle-free IDs, with an assurance of security for their credentials and data; technology advances and private sector initiatives are enabling and enhancing this security, facilitating streamlined ID interfaces and efficiencies.

This trend is reflected in the security features seen on security documents across 2020-2025. Of the six features covered in Smithers research (substrates, inks, personalisation print, machine-readable features, DVOIDs, and biometrics) biometrics will see the greatest rise in demand, with inks and DVOIDs seeing the slowest growth.

The evolution of security document is placing an increasing emphasis on security printers, consumables and suppliers to engage with transformative technologies beyond the physical document. The most prominent identified by the Smithers industry survey are:

- Smart borders and biometric digital ID – including the potential for biometric

non-document ID using facial recognition

- Mobile and virtual ID – linked to mobile and digital drivers’ licences that verify a user in real time

- Blockchain – this software is being actively explored for multiple ID applications from refugee authentication to voting programmes and e-government portals

- Multifunction IDs – are increasingly popular with governments, if they can bring together multiple forms of ID in one place, such as a user’s smartphone, in a digital wallet. This segment has the potential to grow at 20% per annum

- Next-level biometrics – non-document ID is already being trialled in a few countries, allowing seamless contactless transition through airports

- Advanced security and data analytics – this has been a focus in several pan-country regions with the sharing of real-time data. Quantum computing has been mooted as a technology that could process the huge volume of data entailed.

The routes to market for these technologies are profiled in

The Future of Personal ID to 2025 along with Covid-19 impact scenarios, and a comprehensive data set segmenting the market across all key metrics for 2015-2025 and presented in over 100 data tables and figures.

Source: Smithers

Source: Smithers