Global value of flexographic printing in 2024 was $230.5 billion, and is forecast to increase at a 3.0% compound annual growth rate (CAGR) through to 2029, according to Smithers, the global authority on print and packaging markets.

Data from its newly published market report –

The Future of Flexographic Printing Markets to 2029 – show this will yield total value of $267.2 billion in 2029 (at constant 2023 pricing).

Flexo output is growing across most applications – notably packaging. It accounts for the overwhelming volume of corrugated board printed. Growth in this segment is forecast to continue; driven by economic demand, particularly from e-commerce and consumer-facing boxes.

Flexible packaging, labels, and folding cartons will also see solid growth. Changes in print buying will make digital more competitive with flexo on shorter runs. Digital printing is well established in labels as a mainstream technology that is competitive with flexo; however, the widespread adoption and strong ongoing sales of hybrid presses mean that flexo volumes are holding up and will continue to grow. In contrast, flexo printing of newspapers, bags and sacks, and envelopes will decline as demand in these end-uses falls.

Worldwide, output on flexo presses was 8.6 trillion A4 sheets in 2024. This will increase to 10.0 trillion in 2029.

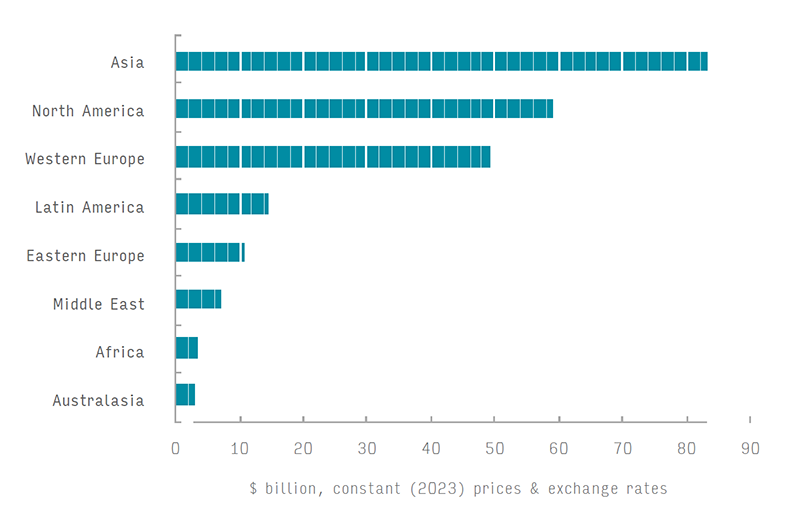

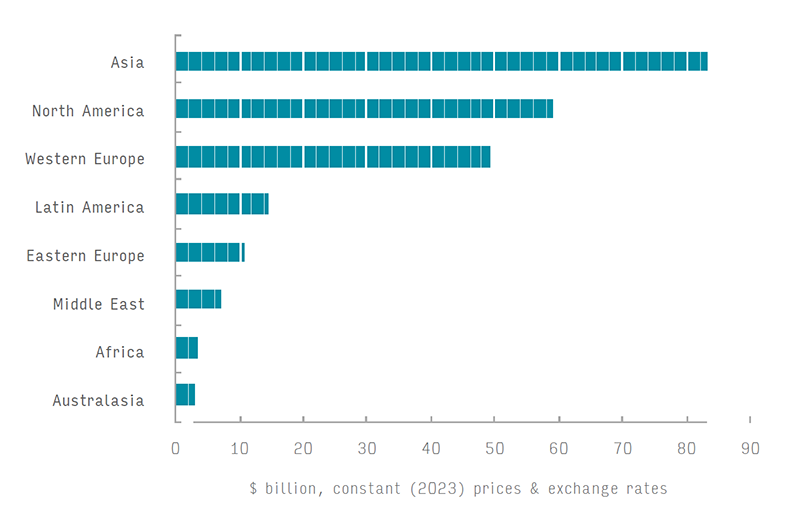

The three largest regions for flexo printing are Asia, North America and Western Europe. Combined, these account for 81.0% of global volume and 83.1% of the value in 2024. Asia is forecast to experience strong growth at a 5.8% CAGR by volume for 2024-2029, with India the fastest growing national market. North America and Western Europe are mature regions for flexo print, and will grow more moderately – 2.3% CAGR and 1.7% CAGR, respectively – across the same period.

The Future of Flexographic Printing Markets to 2029 segments the flexo print market by end-use application, geographic region, and key national market; and includes data on installed base and future equipment sales by flexo press format, and consumables (plates and inks). Its market forecasting is contextualized by analysis of the leading commercial and technology developments, trends in packaging consumption, and increased competition from inkjet systems.

Fig 1: Flexo print output value by region 2024 ($ billion, constant (2023) prices & exchange rates)

Source: Smithers

Source: Smithers

Source: Smithers

Source: Smithers